rsu tax rate california

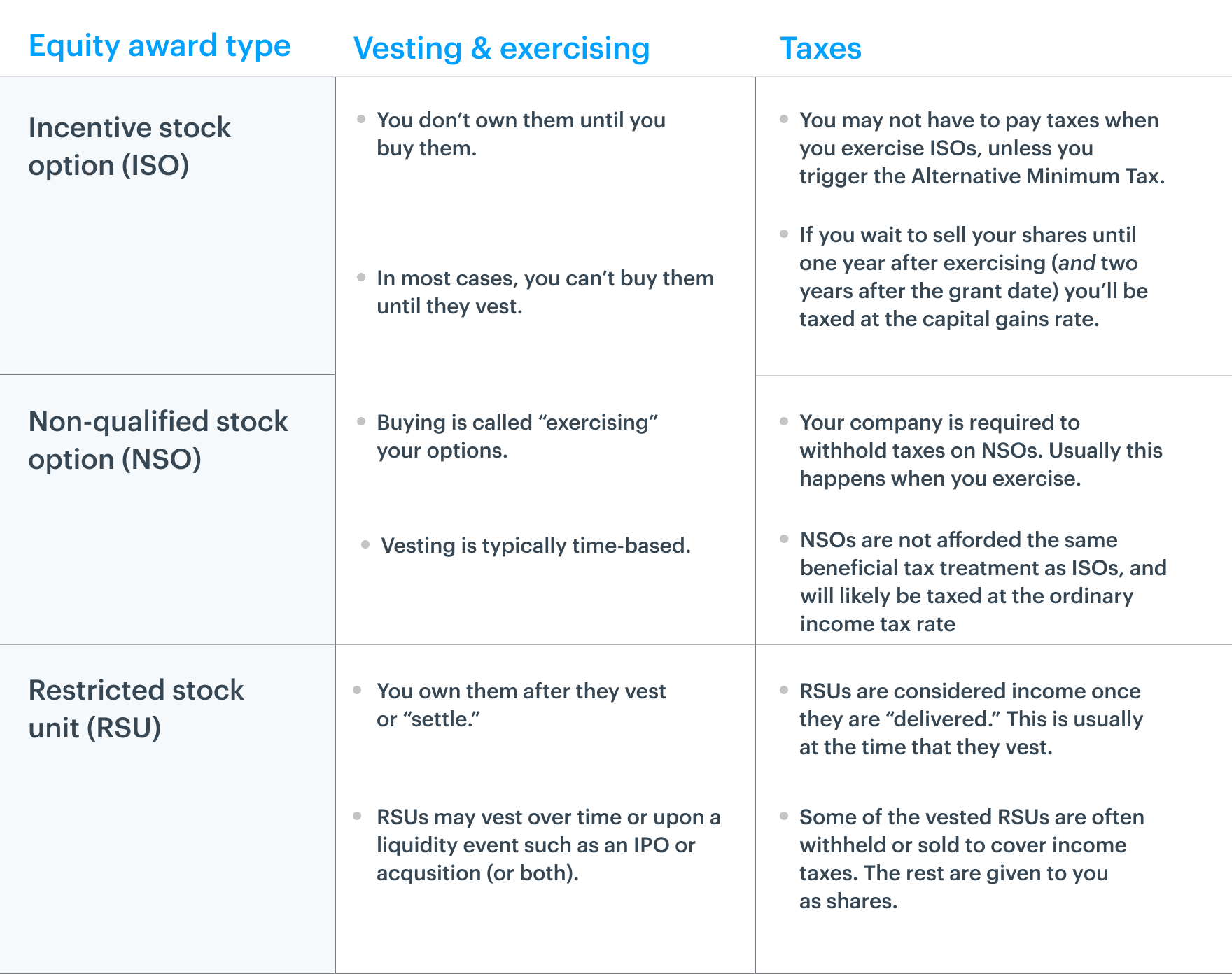

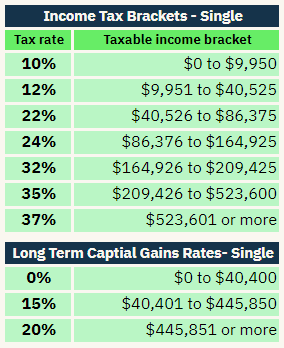

The capital gains tax rate when you sell the shares you own. Also restricted stock units are subject to withholding for social security taxes and medicare taxes.

Rsus And The Expatriation Tax Sf Tax Counsel

Carol Nachbaur April 29 2022.

. Its important to remember that the. The capital gains tax rate when you sell the shares you own. Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry.

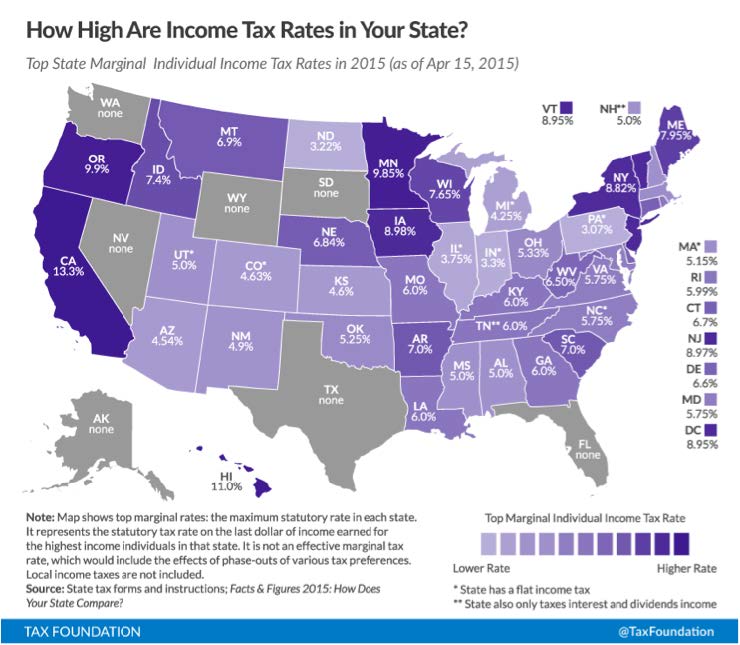

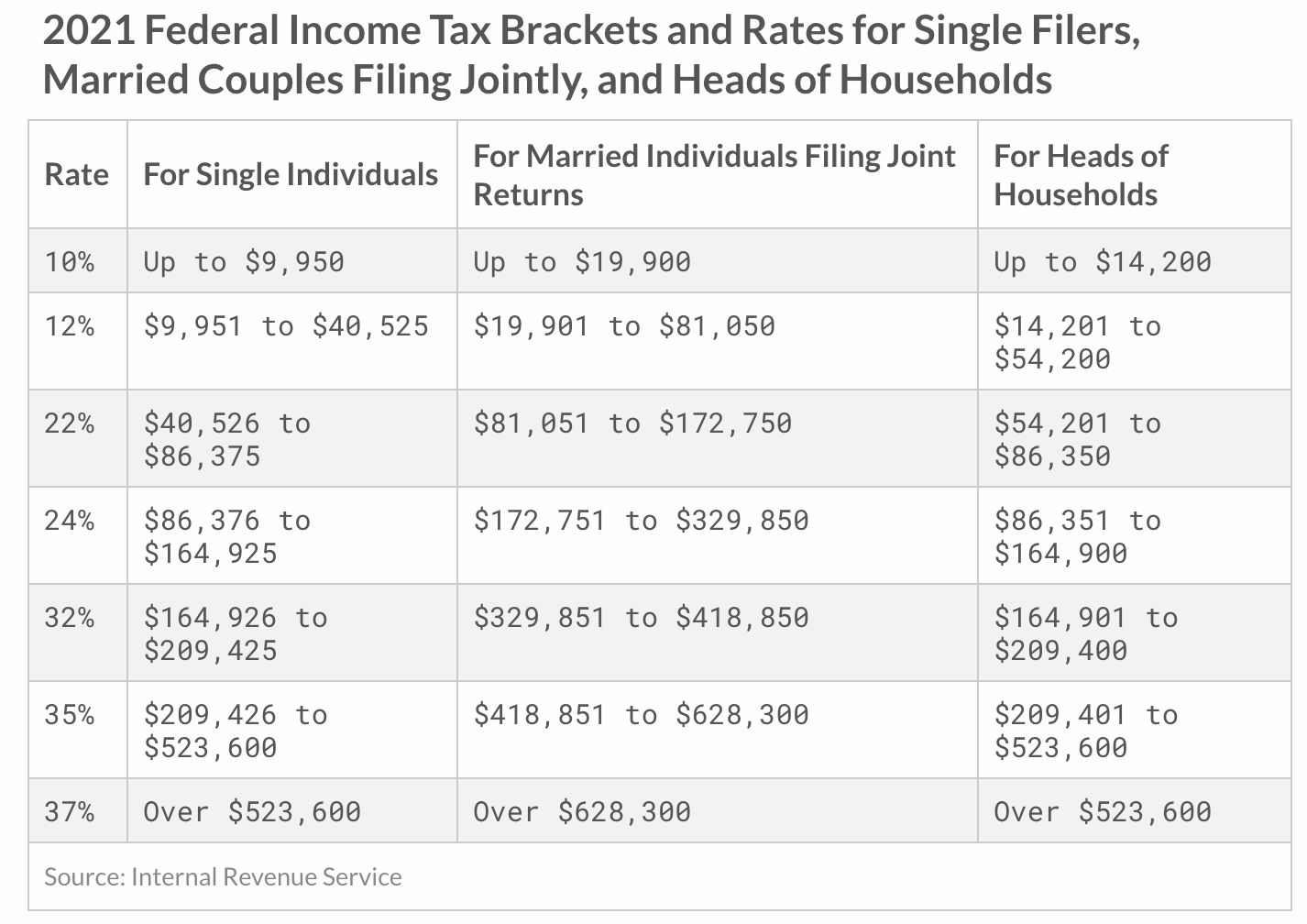

Different taxes apply based on the RSU lifecycle. Most companies will withhold federal income taxes at a flat rate of 22. California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated.

What Are Restricted Stock Units. RSUs represent an unsecured promise by the. Step 5 - Review Outputs of RSU Tax Calculator.

Avoid tax surprises that arise from restricted stock units RSUs by being proactive with your RSU tax withholding and estimated tax payments mid-year. RSUs resemble restricted stock options conceptually but differ in some key respects. Restricted Stock Units do not qualify for 83b election only real stock can qualify.

Once all the assumptions have been entered the RSU tax calculator will provide three outputs and they are all pretty self. Spouse with a california agi of 90896 or less 120 credit individual tax rates the maximum rate for individuals is 12 3. They are not stock until they vest.

If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k. This will result in another 765 in tax liability. With an all-in tax rate of 15 you only need to pay.

C2reason 8 yr. Restricted stock units RSU are not taxed like stock options. 2510276 43 withholding that you saw.

Vesting after making over 137700. Theyre taxed as ordinary income - so its based on your marginal tax bracket. California taxes vested RSUs as income.

Vesting after Social Security max. Answer 1 of 4. California taxes the resulting ordinary income and capital gain because you are a California resident when the stock is sold.

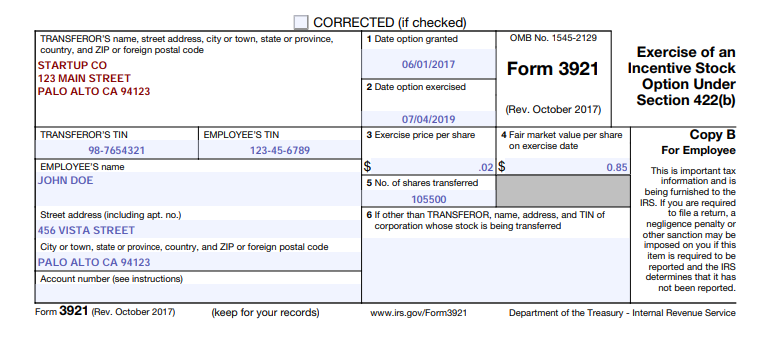

For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income. Your company is required to withhold a fixed. Vesting after making over.

If you also paid tax to Massachusetts California may allow a. The value of over 1 million will be taxed at. As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs.

Click here now to learn how they work how they are taxed and how to report them in 2022. RSUs are supplemental income - theyre withheld at a 25 federal rate and a 102 rate in CA. Vesting after Medicare Surtax max.

The four taxes youll owe when you receive a paycheck or when an RSU vests include. California taxation of RSU income happens in two steps. How is RSU state tax calculated.

For a list of your current and historical rates go to the California City. You are granted 10000 rsus shares of company stock that vest at a rate of 25 a year. Taxes on Restricted Stock Units.

When the units vest the value on the date of vest is. In order to make. RSUs including so-called double.

Social Security Tax - 62 up to. At any rate RSUs are seen as supplemental income. Federal Income Tax - Varies based on income.

In addition the RSUs may be subject to.

Should My W2 Include Income From An 83 B Election

7 Things You Need To Know About Your Restricted Stock Units Rsus X And Y Advisors Inc

Restricted Stock Unit Rsu How It Works And Pros And Cons

How Equity Holding Employees Can Prepare For An Ipo Carta

The Holloway Guide To Equity Compensation Holloway

How To Accomplish A Techxit Part 2 Brooklyn Fi

Rsus In A Divorce Divorce Mediator And Divorce Financial Analyst

Do Rsus Count As Income For A Home Loan Carlyle Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Common Rsu Misconceptions Brooklyn Fi

:max_bytes(150000):strip_icc()/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana